workers comp taxes texas

Let our Experts Guide you to the Right Workers Comp Insurance Plan. Workers Comp Exemptions in Texas Sole-Proprietors and Partners who include themselves on a workers compensation policy must use a flat payroll amount of 63100 for rating their overall workers compensation cost.

5 Requirements For Workers Compensation Eligibility

Workers comp benefits are generally tax-free however you may need to pay taxes in one instance.

. You do not need to claim the income benefits from workers compensation you receive on your taxes. Reporting and Payment Requirements. In General Workers Comp Settlements Are Not Taxable.

Still we encourage you to speak with a financial professional to make sure that you follow all state and local tax guidelines. Texas requires that all businesses involved in projects for government entities carry workers compensation insurance. Past due taxes are charged interest beginning 61 days after the due date.

Ad Compare Texas Workers Comp Insurance Quotes Online Save 55 - 75. Texas law does not deem compensatory damages awarded for bodily. You will typically not have to pay taxes on a workers compensation settlement at the state or federal level in Texas.

The Texas Workforce Commission indicates that the effective tax rate in 2019 ranges from a minimum of 036 paid by 656 of employers to a maximum of 636 paid by 53 of employers for experienced-rated accounts and the average experience tax rate is 106. Up to 25 cash back Workers comp will also pay up to 10000 for burial expenses. Limitations of Workers Comp Benefits.

The short answer is. For the most part you will not have to list workers compensation settlement money as income when filing your taxes. Youll receive only a portion of your lost wages although it may help to learn that workers comp benefits are generally tax-free.

Vary each year as adopted by the Texas Department of Insurance. Texas unlike other states does not require an employer to have workers compensation coverage. Your taxable wages are the sum of the wages you pay up to 9000 per employee per year.

If tax is paid 1-30 days after the due date a 5 percent penalty is assessed. Texas Workers Compensation Act in PDF format. Being a non-subscriber ie going bare or without.

See our online resources. In addition you cant receive any payment for the. Insurers licensed by the Texas Department of Insurance and self-insurance groups that write workers compensation insurance coverage must pay this tax.

The SSDI benefits may be taxable if they are reduced by workers comp benefits. Make Sure Youre Protected From Unexpected Accidents. The benefits from workers compensation are typically not taxable in Texas.

Maximum Tax Rate for 2022 is 631 percent. Minimum Tax Rate for 2022 is 031 percent. Enter Your Zip to Start.

Subscribing to workers compensation insurance puts a limit on the amount and type of compensation that an injured employee may receive - the limits are set in the law. Ad Its Fast Easy To Get Workers Comp Coverage. As you can see there are limits to workers comp benefits.

You pay unemployment tax on the first 9000 that each employee earns during the calendar year. For workers compensation questions concerning the Uvalde event visit our staff at Family Assistance Center Uvalde County Fairplex 215 Veterans Lane or call us at 800-252-7031 option 1. This is also true if you are the beneficiary of a payout.

Workers compensation settlements are not taxable in Texas. Ad Looking For Workers Comp Insurance. Fill Out 1 Easy Form Get 5 Quotes Save Up to 75.

Per the IRS you are not required to pay tax on the funds you receive from your workers compensation settlement. To calculate interest on past due taxes visit Interest Owed and Earned. If tax is paid over 30 days after the due date a 10 percent penalty is assessed.

The Texas workers compensation statutes are located in Texas Labor Code Title 5. COLLECTION OF TAX AFTER WITHDRAWAL FROM BUSINESS. A person with a disability can receive financial aid from Social Security Disability Insurance SSDI if they meet program qualifications.

Refer to 28 TAC Rule 1414 and our publication Insurance Maintenance Tax Rates and Assessments on Premiums. Sole Props Entrepreneurs Small Shops Side Hustles.

Are Workers Comp Benefits Adequate Legal Talk Network

Average Workers Comp Settlement What Amount To Expect Kk O

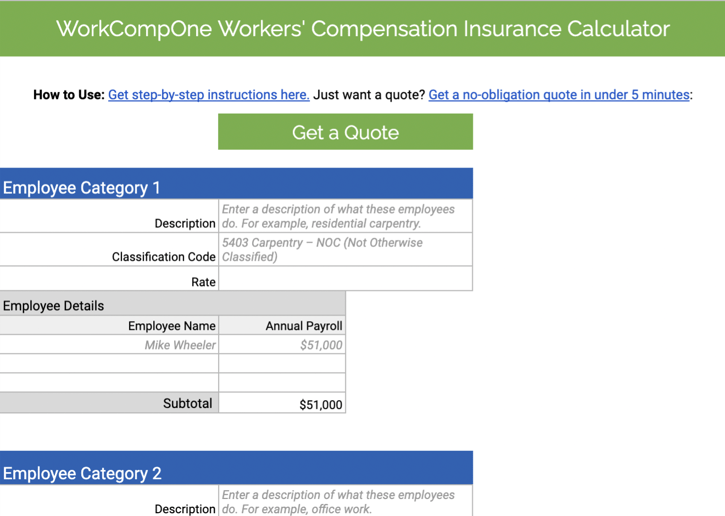

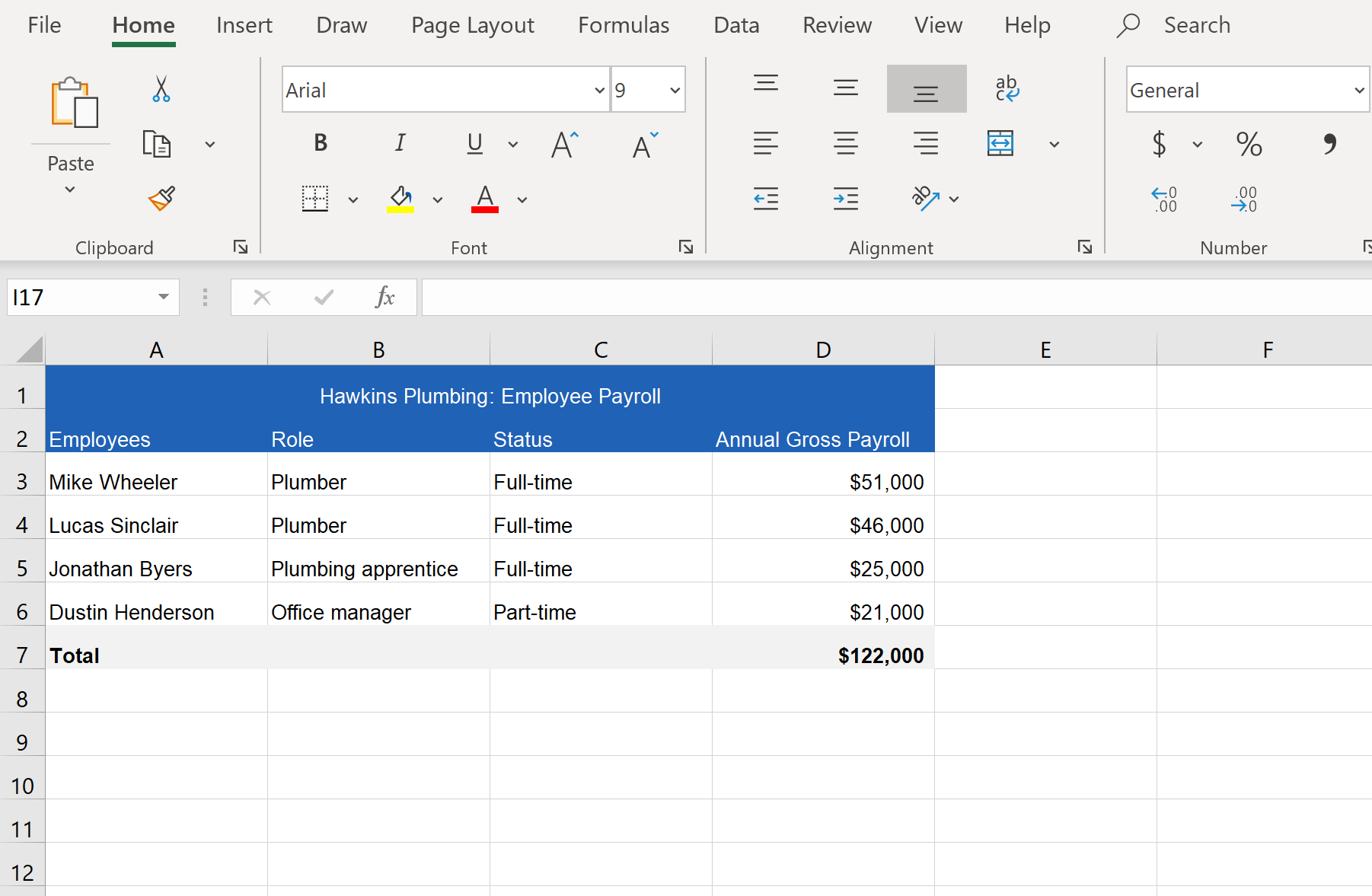

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

Texas Workers Compensation Laws Costs Providers

What Wages Are Subject To Workers Comp Hourly Inc

What Is Workers Compensation Article

Texas Non Subscriber How Can Injured Worker S Get Compensation

York Pa Workers Compensation Attorneys Free Confidential Consultation

How Long Can A Workers Comp Claim Stay Open Canal Hr

Workers Compensation Payroll Calculation How To Get It Right

Is Workers Comp Taxable Hourly Inc

How To Calculate Workers Compensation Cost Per Employee Pie Insurance